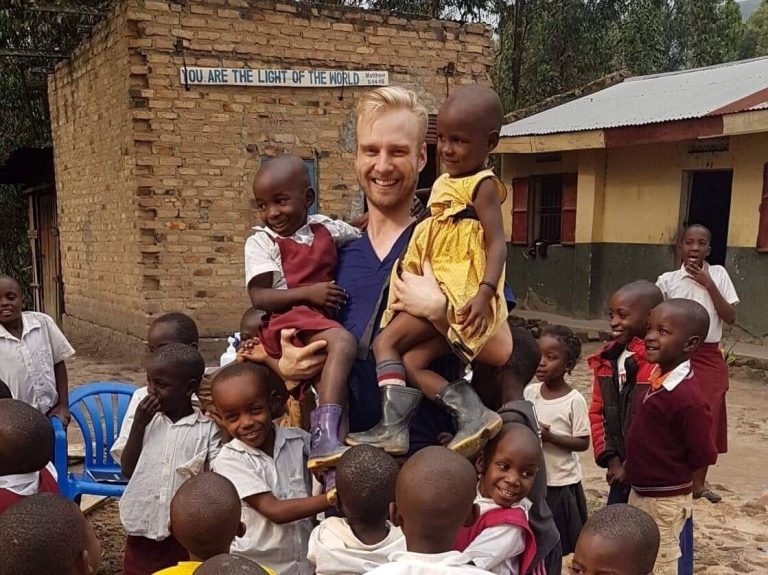

Golden Key Spotlight: Michael A. Cowling

Perhaps the truest sign of real passion is what someone chooses to focus on whilst facing a life-threatening illness. My name is Michael Cowling, and I joined Golden Key in 1997, having been invited during the first year of my Bachelor of Information Technology degree